You’ve found your dream home, and now you’re looking for ways to afford that dream home. So which type of financing do you go for? Traditionally, home buyers would opt for the usual full flexi-loan due to its repayment flexibility. However, now that there are other financing alternatives available, buyers may want to revaluate their options, in particular, the rent-to-own (RTO) scheme.

The Rent-To-Own (RTO) Scheme

As announced in the recent Malaysia Budget 2020, the government will collaborate with financial institutions to achieve their vision of making housing more affordable in order to assist those who are unable to afford the initial 10% downpayment fund required to purchase property. The initiative states that up to RM10 billion will be provided by financial institutions with support from the government via a 30% or RM3 billion guarantee.

According to Finance Minister Lim Guan Eng, the RTO scheme was dedicated towards the purchase of first homes, with a property value of up to RM500,000 whereby applicants are allowed to rent the property for up to five years and following the first year, the tenant will be granted the option to purchase the property. It was also added that the value of the property would be based on the price agreed upon at the time the tenancy agreement was signed. Besides that, the government would also provide stamp duty exemptions between the developer and financial institutions, and between financial institutions and the prospective buyer.

Of course the scheme does come with its repercussions, one of it being the fact that there’s an option fee should tenants decide to purchase the property; a typical figure is roughly 5% of the property price. In addition to that, the monthly rental rate will also be higher than the current market rate. However, a certain percentage of the increased rental rate will be credited towards the future purchase of the property. Therefore, the total amount the buyer would have to pay should they decide to purchase the rented property will be reduced, helping them save in the long run.

Through the RTO scheme, it grants home buyers the opportunity to test out a certain property prior to purchasing it. It also allows them to lock in the price based on the current market value in the event that they do decide to purchase it as they won’t be affected by an increase in the property’s price (capital appreciation) over the years.

Full Flexi-Loan

When you apply for a full flexi-loan, you’ll usually open a property loan account and a current account. In doing so, you must ensure that your current account is credited with enough funds each month, as the instalment payments will be deducted from said account to the property loan account.

With a full flexi-loan, borrowers will have the option to reduce the loan amount by depositing additional funds into the current account, which will then be reflected in the total amount to be repaid. As a result, buyers are able to reduce their interest charges via a simple and efficient way, without being faced with additional charges. As an example, if your initial loan amount is RM500,000, and you decide to deposit RM100,000 into your current account, your loan repayment calculations will be based on the difference between the two amounts, which in this case is RM400,000. Hence, your interest charges will also decrease.

A full flexi-loan is suitable for those with sufficient amount of savings and intend to save on interest payments. It is also for those who aim to seek moving to a new property within the next 10 years, therefore upon selling their current property, they’ll pay less in terms of interest compared to those who took a shorter loan tenure. It’s important to note that a full flexi-loan is more suitable for those who have the financial stability to deposit extra funds each month, on top of the set repayment amount. This ensures that there’s always a contribution going towards reducing the interest charges and initial loan amount.

Do not fret should you not be able to afford taking up a full flexi-loan, as you could always opt for the RTO scheme, granting you more time to save up onfunds, at the same time it gives you the flexibility to determine if the property is truly suitable for you. Hence, should you suddenly change your mind, you have the chance to opt out – only having to pay some minimal fees.

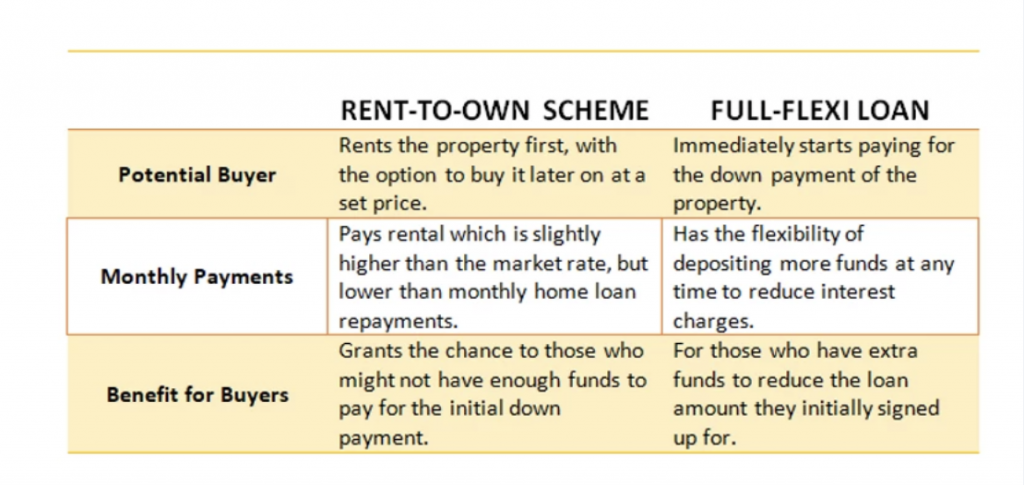

Have a look at the table below for a short summary on the main differences between the RTO scheme and the full flexi-loan:

Take time to weigh your options and make the necessary calculations before choosing what is best for you. Should you need help weighing out the pros and cons, feel free to reach out to us at +6019 275 8200, and we’d be delighted to advice you on what suits your best interest!