Purchasing your first home could be an intimidating ordeal, do you choose the first house that falls within your price range, or do you go for the one that’s slightly above your budget, but isn’t a sub-sale property? It can be overwhelming and confusing, but it doesn’t have to be. So before making an offer on your dream home, read on to see the essential must-knows.

THINGS TO CONSIDER BEFORE YOU PURCHASE

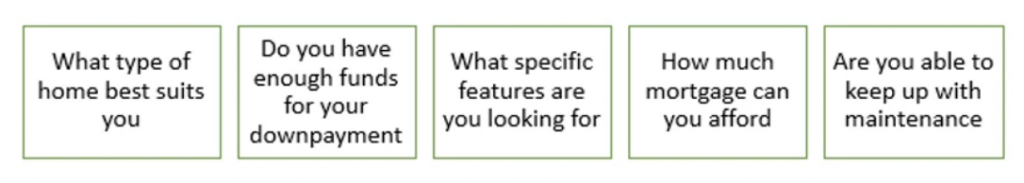

Whether you’re looking for landed terrace house, or a high-rise property, it all comes down to your homeownership goals. Here are some questions you’ll need to ask yourself before starting your hunt for your dream home:

Other additional fees that you’ll have to be prepared for:

- Legal fees

- Stamp duties

- Sales & Purchase Agreement (SPA) fees

- Valuation Fees

FIND A GOOD REALTOR

Once you have determined how much you can really spend and you’re confident with your finances, your next move should be to find a good real estate agent. your realtor should be able to make sound recommendations and explain the market to help you find a home that suits your budget, as well as your needs, Upon making an offer on a property, your realtor will negotiate with the developer or seller and draw up terms that favor both parties.

SHOPPING FOR THE PERFECT HOME LOANS

The most prominent aspect to consider when scouting for a suitable home loan is its interest rate; it could either be a fixed or floating interest rate. A fixed interest rate is ideal as it means that the interest rate throughout your loan term would remain unchanged, whereas a floating interest rate is dependable on Bank Negara’s Base Lending Rate (BLR), therefore has the possibility to fluctuate based on the BLR movement. Do note that if you’re looking to purchase a sub-sale property, this process will involve a property valuation, where it requires you to pay for a valuation report. This is done by the bank, who will engage a valuer to physically inspect the potential property to be purchased.

To qualify for a home loan, you’ll first have to calculate you Debt Service Ratio. In doing so, your credit score is one of the most prominent factors in determining if you qualify for a home loan. The bank will calculate your repayment capabilities using the Debt to Service Ratio (DSR), a calculation that indicates the proportion of your debt in relation to your total income. Every bank has a maximum DSR cap imposed on a borrower in order for their loan application to be approved. Your DSR percentage should be lower than 70% for your loan to be approved.

Next, check on your Central Credit Reference Information System (CCRIS) report, which displays all of your total credits, interest charges and other outstanding charges for all loans that you have with any bank in Malaysia, including personal loans and credit cards, to hire purchase and overdrafts. Delay in repayments for any obligation will show up in your report and is recorded as “1”. Banks mainly requires records of zeroes as it shows that you have a good credit score.

Meanwhile, there is also the Credit Tip Of System (CTOS), which gathers information of summons and bankruptcy on individuals and companies from various sources found in the public domain. Banks examine the information provided by CTOS and decide if it is relevant to your application. It is crucial to keep track of your CTOS report to ensure there is no incriminating information that may jeapardise your chances of getting a home loan.Upon clearing all of the criterias above, your home loan should be approved.

CLOSE THE DEAL!

For a sub-sale property, once you and the seller have agreed on a purchase price, you will need to sign a standard document known as the Letter of Offer (LOA) and pay the 2% earnest deposit. This document will contain the following details:

- Names of seller and buyer

- Property address

- Agreed-upon price & deposit amount

- Any items such as fittings included in the sale

The LOA also states the date before which the SPA must be signed. Usually, it is within 14 days. Your lawyer will then prepare the SPA and get both parties to sign them accordingly. You will then have to pay the remaining 7-8% downpayment as well as your stamp duty fees. Your lawyer will also draft out the loan agreement to be signed by both you and your bank, where the bank may ask you to take out an insurance policy.If you opt for a new property instead, you’ll need to pay the booking fee of 2% or 3%, depending on what the developer sets. After the booking fee is paid, a 10% deposit must be paid as the first payment. However, if 2% or 3% was already paid, another 7% or 8% must be added depending on the amount of the booking fee paid. After these initial payments, the rest of the 90% must be paid according to the fees schedule, as per stated in the SPA. Following that, you’ll have to wait for your home to be completed before vacant possession and securing the keys to your home. After which, you’ll be able to move in!

Purchasing your dream home may seem complicated, but we assure you, once you’ve gotten into the groove of things, the process will be a breeze! Let Profere Property Management help get you there. Call us now at +6019-2758200 and we’ll help you figure out a solution that’s fit just for you!